Info Deck for Platform Capitalism

Disclaimer: Reading these notes doesn't come close to reading the book. Head to our link in bio to buy Nick Srnicek's "Platform Capitalism."

Chapter 1 in Standard Terms (Simple Terms coming soon). Platform Capitalism is a set of economic tendencies that emerged with the rise of digital platforms (e.g. Amazon, Google, Facebook, Uber...). Platforms collect user data while facilitating the exchange of goods. This gives them great near-insurmountable advantages.

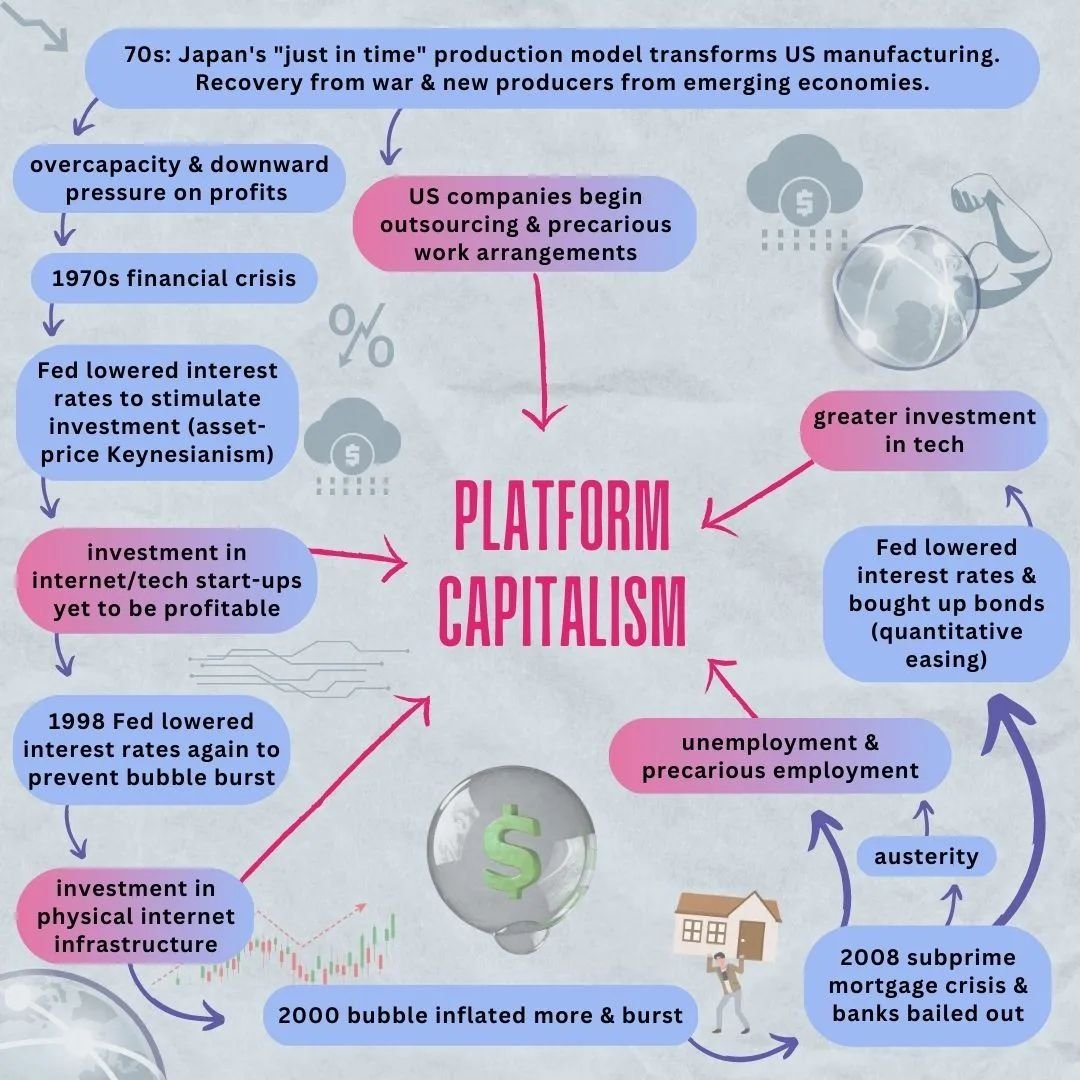

What led to today's platform capitalism? 70s, 90s, & 2008 financial crises shaped the economic landscape (i.e. Fed monetary policy and precarious employment) that gave rise to platform capitalism. 70s: US mass production was transformed by Japan's lean "just in time" production which introduced outsourcing & precarious work. Nonetheless, recovery from the war and the emergence of new producers created a glut in global production capacity, pushing downward on price & profits of manufacturing in the advanced economies, resulting in a financial crisis. In response, the Fed lowered interest rates to stimulate investment and create wealth (and thus consumer demand) by inflating stock prices. This "asset-price Keynesianism" stimulated investment in internet start-ups, which hadn't yet shown themselves profitable. 90s: This led to the 1990s tech bubble, which, despite the Fed's lowering of interest rates again, popped in 2000.

Despite the meltdown, the Fed's ultraaccommodative monetary policy led to investments that laid the physical infrastructure for the internet and digital economy. 2008: Low interest rates fueled the subprime mortgage crisis leading to the 2008 collapse, which resulted in austerity policies, and the Fed's ultraaccomodative monetary policy (e.g. quantitative easing) which again enabled greater investment in tech.

Chapter2 Data has become a raw material

that can give a platform competitive advantage. Besides allowing targeted advertising, data collection optimizes production. Rather than sell products, platforms lease them and gather usage

data. 5 types of platforms have emerged, which are owning the social infrastructure upon which businesses and people rely to connect with each other.

1) Advertising Platforms

After the 1990s dot-com bust, venture capital funding dried up, making it difficult for new competitors and pushing existing platforms to start generating revenue. As a result, Google and Facebook exploited user data to target advertising and generated large influxes of cash that would be kept at tax havens to be used in mergers & acquisitions, further concentrating ownership.

2) Cloud Platforms

While Amazon Prime & Kindle aren't profitable ventures, they entice users whose data is extracted for profit. Amazon also profits by renting Amazon Web Services (AWS) as a Cloud Platform, which started off as its own internal computing infrastructure (servers, storage, software tools, warehouse workers...). Now clients from all industries rely on AWS for automation, data collection, efficiency optimization, and decision-making, allowing Amazon to own and control the infrastructure necessary to every other industry.

3) By embedding data-collecting sensors,

chips, & trackers into the production

process, the industrial platform can increase efficiency by communicating the state of production as well as of machine components (wear & tear, errors...). It also collects usage data without having to do surveys. Companies like MindSphere and Predix are emerging as monopolies that produce these tools and services for companies.

4) Product Platforms

Product platforms rather than selling

their products, offer subscriptions and leases instead, while gathering usage data from the product to gain a strategic edge. Wage stagnation and the decline of savings has made big-ticket purchases (e.g. cars) impossible for many, making product rentals / subscriptions more enticing. Examples: Ro

Chapter 3: Great Platform Wars

Intro

Due to the network effect, data collection, & high barrier to entry, platforms trend toward centralization & monopolization. Thus, what is likely to happen is a change in the nature of competition: shifting away from price competition toward stronger data extraction.

Tendencies:

DATA EXTRACTION

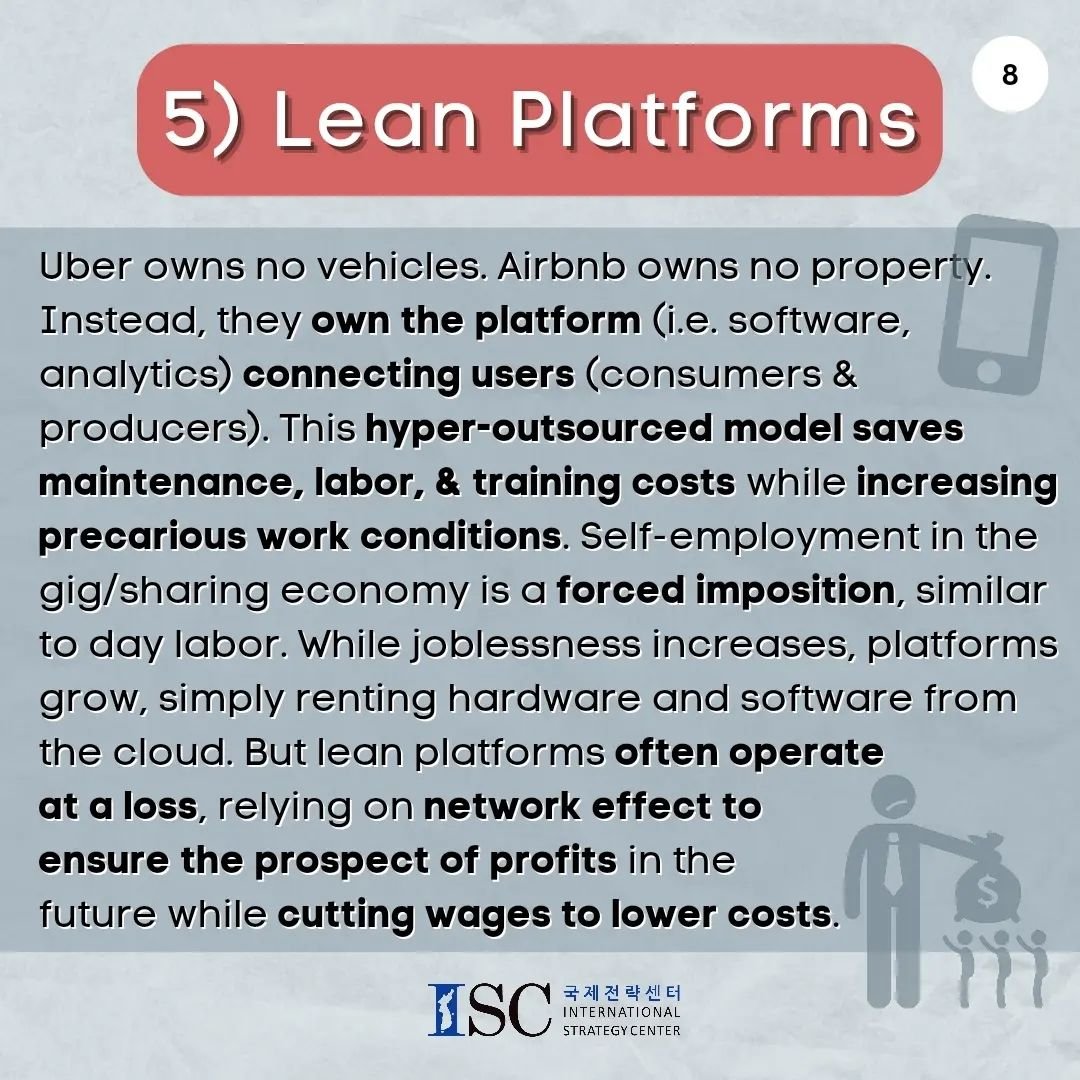

GATEKEEPING

CONVERGENCE of MARKETS

ECOSYSTEM ENCLOSURE / SILOED PLATFORMS

Challenges (A)

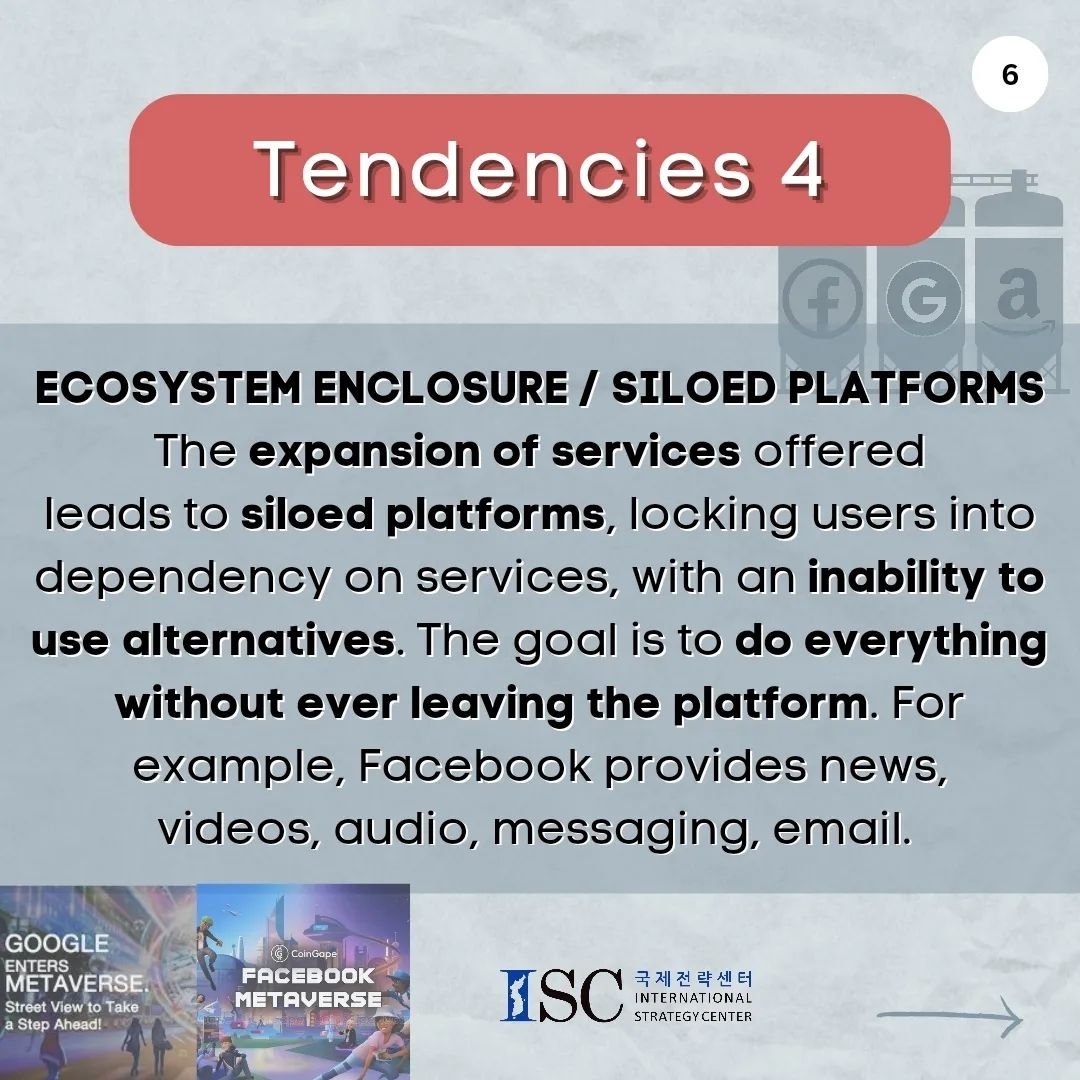

Lean platforms' low profit margins mean difficulty in markets with infrequent services (e.g. grocery shopping, cleaning). In addition, lean platforms outsource labor and therefore cannot supply high-skill & high-quality jobs that require training, and can't benefit from economies of scale. Furthermore, platform workers are unionizing and pushing back against wage cuts. In addition, VC funding is drying up threatening the future viability of these platforms.

Challenges (B)

To survive, platforms can cut costs & increase prices to become a luxury brand or high-price on-demand convenience...but many may go out of business. While the 90s tech boom left us with the basis for the internet, the 2010s tech boom will leave us with premium services for the rich. Furthermore, advertising platforms must take into account that ad spending is decreasing globally. Plus, it's unclear whether advertising can overcome ad blockers, fake ad views bots, & spam.

Futures

Ads may decline and payper-view models / direct payments may rise, as enclosure into ad-blocking apps rises. VC funded lean platforms may go bankrupt, shifting to product platforms (like Uber's driverless cars). While some people see co-ops as possible alternatives, co-ops aren't able to go up against the data, network effect, and financial resources of large platform monopolies. The only real solution are public platforms that harness the power of the state while still being controlled by people. These public platforms could be used to distribute resources more effectively, enable democratic participation,and furt.